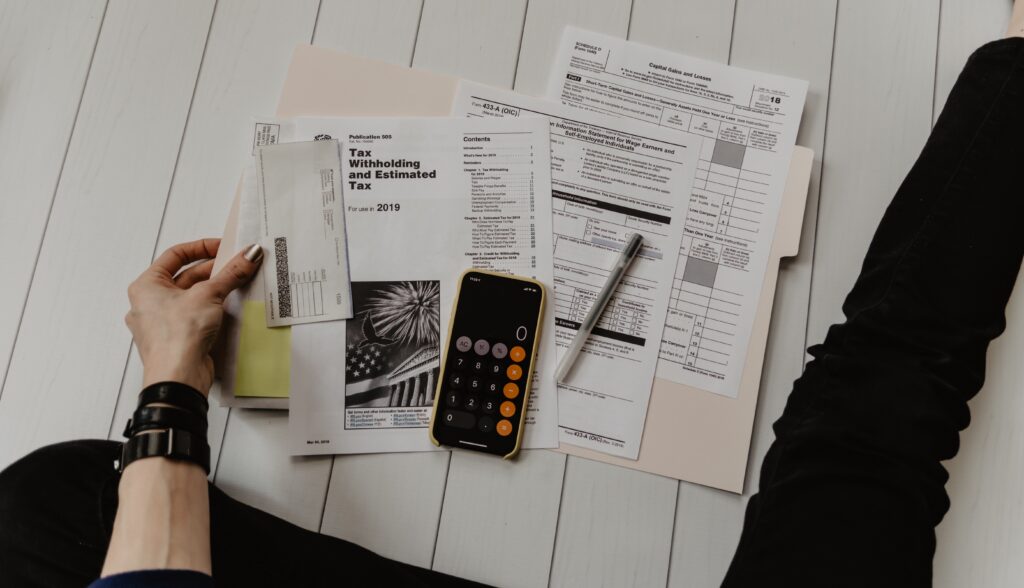

April will be here before you know it, and so will that mid-month deadline for filing your tax returns. If you haven’t already tried electronic filing, give it a go. But with so many programs that offer roughly the same service, how’s a tax e-filer to choose? I checked out some popular options so you wouldn’t have to.

,

I’m not sure if it’s intentional, but the pricing plans offered by some of the major tax preparation services — TurboTax, H&R Block and FreeTax USA — are confusing. Their home pages are emblazoned with the word “free,” but that typically only refers to filing a basic federal 1040EZ form. Charges increase for filing additional federal and state forms. The programs offer different support structures based on the package.

I’ll explain options for common needs.

The Budget do-it-yourself Tax Pro.

If you’ve filed your own taxes in the past and have a straightforward financial picture, FreeTax USA is an easy, inexpensive way to file electronically. The basic version is free and includes a tutorial as well as the ability to file individual deductions and print PDF copies of your returns. State filing is $9.95, and upgrading for an additional $5.95 allows you to amend your return later and get access to audit support if you need it.

The Confident But Cautious Tax Sites.

TurboTax and TaxACT Online will store prior-year returns which, depending on the package you choose, you can access for reminders of what you’ve deducted in the past. Each program offers a “Maximum Refund Pledge” to return your money if another preparer uses the same information and generates a larger refund. But, seriously, who’s going to do their taxes twice just to check?

TurboTax is one of the largest names in online tax-preparation software. Unlike FreeTax USA, it allows phone access to tax professionals to help you through your filing if you hit a snag. Its professionals will even spot-check your return before you file. TurboTax packages range from “free” to $129.95 for the business edition. Most users will be well served by the $29.95 deluxe edition, plus $36.95 per state filing. The included audit support (via phone or online chat) is a comforting feature.

TaxAct Online offers many of the same perks as TurboTax, but only its audit support seems to be provided by a tax professional. The Ultimate Bundle ($17.95) includes a single state filing and phone, email and audit support. If you think you’ll want access to a tax professional while you’re working on your returns, stick with TurboTax.

The Nervous Newbie, Don’t Worry These Tax Tips Are Easy.

Those filing online for the first time should consider H&R Block’s $79.95 “Best of Both Worlds” option (state filing is an additional $34.95). It includes the premium version (good for the self-employed or owners of rental property) and a personalized review of your taxes done by an H&R Block tax professional. You’re matched with a single tax professional for unlimited help and support instead of being sent to a general call-in service. If you’re audited, H&R Block will provide you with legal representation, a benefit unmatched by other programs. If an error in representatives’ calculations results in IRS penalties and/or interest, the company will foot the bill.

About The Author: Andrea Eldridge is CEO and co-founder of Nerds On Call, a computer repair company that specializes in on-site and online service for homes and businesses. Andrea is the writer of a weekly column, Nerd Chick Adventures in The Record Searchlight. She prepares TV segments for and appears regularly on CBS, CW and FOX on shows such as Good Day Sacramento, More Good Day Portland, and CBS 13 News, offering viewers technology and lifestyle tips. See Andrea in action at callnerds.com/andrea/.