This content has been archived. It may no longer be relevant

Online Scams in 2022 To Look Out For

By Andrea Eldridge

While we can probably all collectively resolve not to respond to those incessant extended auto warranty calls, identity theft and phishing scams grow ever more sophisticated each year. In honor of the New Year, I recently chatted with Steve Gibson and Clark Schopflin on KQMS in Redding, CA to take a collective refresher course on how to spot & avoid getting scammed this year.

Common scams of 2022

- Phishing scams: scammers attempt to dupe you into supplying personal details, banking information or account login details so they can gain access to your banking accounts or set up new accounts in your name.

- Social Security scams: scammers pretend to be from the Social Security Administration to trick you into giving out your social security number, or money.

- Online purchase scams – scammers list a product or service for sale, often on marketplace or social media sites. You buy and they never supply it. The BBB found that pets and pet supplies accounted for over a third of online purchase scams in 2020.

- Robocalls (automated robotic-like calls)promising to lower your credit card interest rate (you just need to supply details about your credit card)

- Health insurance scams: callers try to convince you to sign up for cheap health insurance (to get you to supply personal details)

- Anydesk scams: scammers convince you to install remote-access software such as Anydesk on your computer to see photos or videos or for some other reason, then use that access to steal bank logins, passwords & account access.

- “Romance Scams” or Google Hangout Scams: scammers post fake dating profiles on dating sites or apps and try to lure people to connect via Google Hangout (to make whereabouts less traceable), concoct elaborate scenarios of need and convince victims to send money to help them. According to the FTC, people lost $304 million to romance scams in 2020

Tip #1 – Trust no one. Confirm independently.

If you get a call, text or email claiming that

- Your bank account or credit card has been blocked

- A shipment has been delayed due to missing delivery information – even if it looks like UPS or AmazoN

- Fraudulent activity has been noted on your account

And prompting you to supply personal details or account login info to “fix it” – Do NOT click any links, reply or respond.

Confirm the info yourself by calling your bank or credit card company, or login to your account by going to a trusted web address or phone number. Do NOT use a phone number, link or email address supplied in the questionable email or text.

Always manually visit a website using your browser instead of clicking on a link in an email or text

Do not agree to install remote-access software on your computer unless you know and trust the company. We use remote support software to fix customer computer issues remotely, but you do not need to install remote access software like Anydesk (for example) to see photos or videos.

Tip #2 – Check the sender

Be instantly suspicious of calls, texts or emails from an unknown number or address.

Many scammers use a number from your cellphone’s area code to appear legit. Others use area codes metro areas that have IT support centers from which you may at times receive legitimate calls, such as 559 (Fresno) or 469 (Dallas-Ft. Worth)

Companies like your bank, Verizon or Comcast won’t text you from a regular phone.

- They typically use automated text services that appear on your phone like a 5-6 digit number.

- A text message received from an individual phone number (an unknown number with an area code), claiming to be from a company (like Verizon or your bank) is not legit

Email addresses can be “spoofed” to appear legit, so investigate the sender email address details

- In Google, click on the Show Details arrow directly below the name of the sender. For other email providers, view the full email header.

- Look at the addresses that populate in the “reply-to” and “mailed-by” fields. If it’s your bank or AT&T, it will show there.

- Check the “signed-by” field for discrepancies. For example, a scam email that shows a sender of support@microsoft.com might show a “signed-by” address of support@microsoft.ontechx.com

- A legit sender address should always END with something like chase.com, paypal.com or capitalone.com.

The portion in front of the @ can be unrecognized, but the words directly in front of the .com or .gov should match the sending institution exactly. If it ends with something like chase.xtechmedia.com that is NOT Chase Bank.

Tip #3 – Recognize Reg Flags

- An unexpected call, text or email stating that one of your accounts has been locked, that there is a problem with a shipment, or that you’ve won something.

- A text or email with a link to click saying something like “you won a prize!” or “unlock your account by clicking here.”

- Anyone contacting you “out of the blue” asking YOU to provide personal or account details.

- A non-native English speaker asking for your personal details. In an email or text, this can appear as misspelled words or odd phrasing.

- Generic greetings like “Dear Sir or Madam” or “Hi Dear.”

- A caller that gets increasingly threatening or aggressive in their attempt to get you to supply personal information.

- Anyone asking you to send money to help a friend or family member in need. Always attempt to contact the person purported to be in need directly. Recruit help from friends or family members to verify the person is truly in trouble.

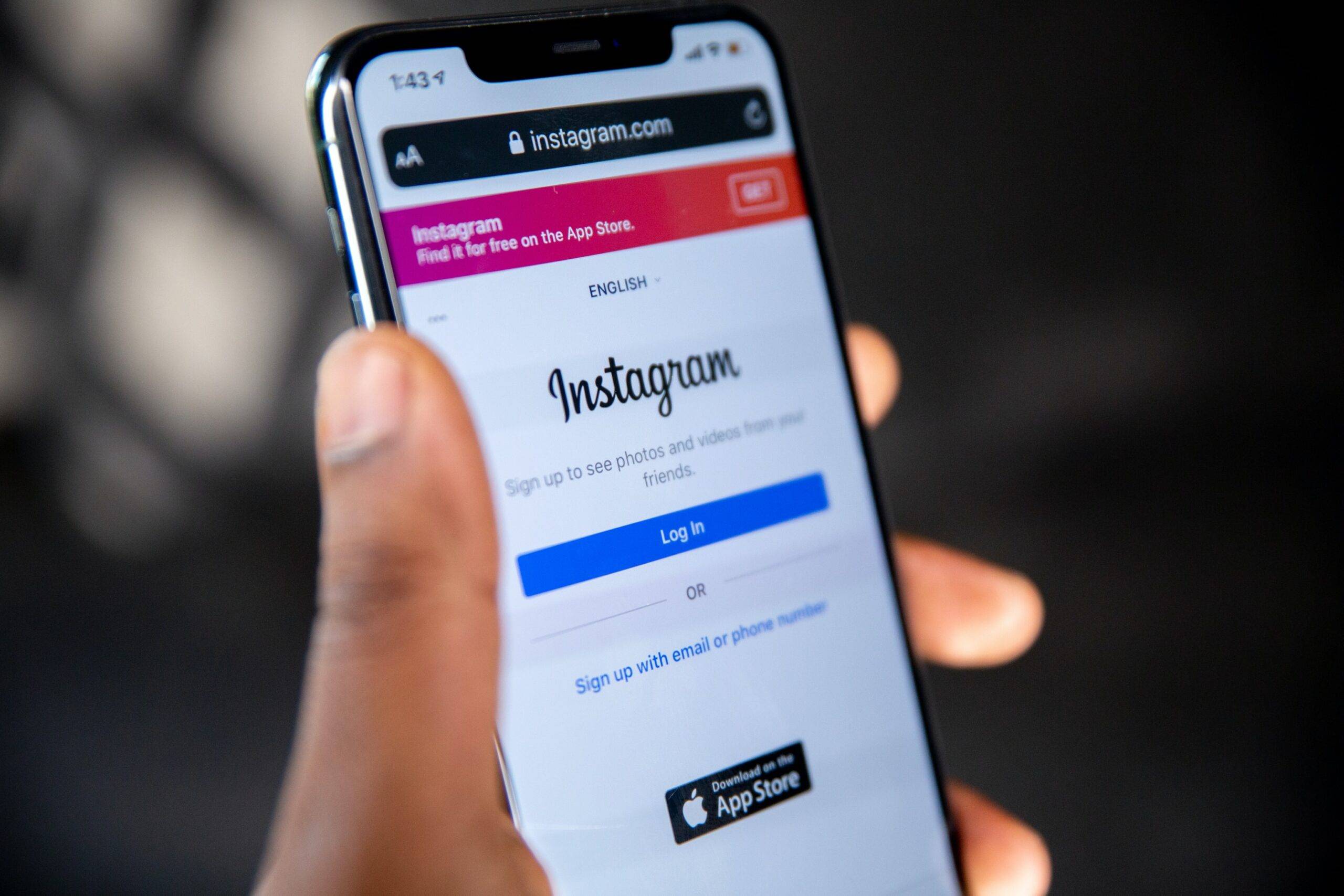

Common social media scam red flags include:

- Messages from strangers claiming to know you – always review the friends of anyone asking to connect with you through social media for “real-life” (personal) connections. A new profile with no friends, or no friends you know, is not your friend.

- URL Links in messages or comments.

- Offers of prizes or pleas for monetary assistance from unknown people.

- Remember that photos and legit details of people you know can be stolen to create a fake profile. Be wary of this kind of messaging even if the sender appears to be a friend.

Tip #4 – Consider Signing up for Credit Monitoring

Credit Monitoring agencies like Experian, TransUnion and Equifax have credit monitoring services that will notify you of unusual activity on your credit file. You can use their app to see if a new any accounts have been opened in your name, or if you’ve had a spending spike on one of your accounts.

Tip #5: Be wary of purchasing items online from strangers

Does the price seem too good to be true? It probably is.

It’s best to buy electronics or expensive items face-to-face, but if you absolutely can’t get that hot-ticket item locally and want to go through a reseller, remember:

- Photos and videos on an eBay or Facebook Marketplace listing can be stolen from other legitimate posts.

- Request live video conference via Zoom or Google Meet to see the seller with the item.

- Check seller reviews and only use sites that guarantee they’ve verified seller identities.

As scammers become more sophisticated, you can too! Protect yourself and your loved ones by arming yourself with information and you’ll be the savvy scam spotter that recognizes all the scurvy scalawags in the year to come.