For those of you asking yourself: “What does a Nerds know about taxes?” the fact of the matter is, many IRS scams involve criminals using technology to find and swindle their victims. Although these particular Nerds do not know how to figure out your tax exemptions, we can help you avoid the most common and pervasive IRS scams currently targeting taxpayers.

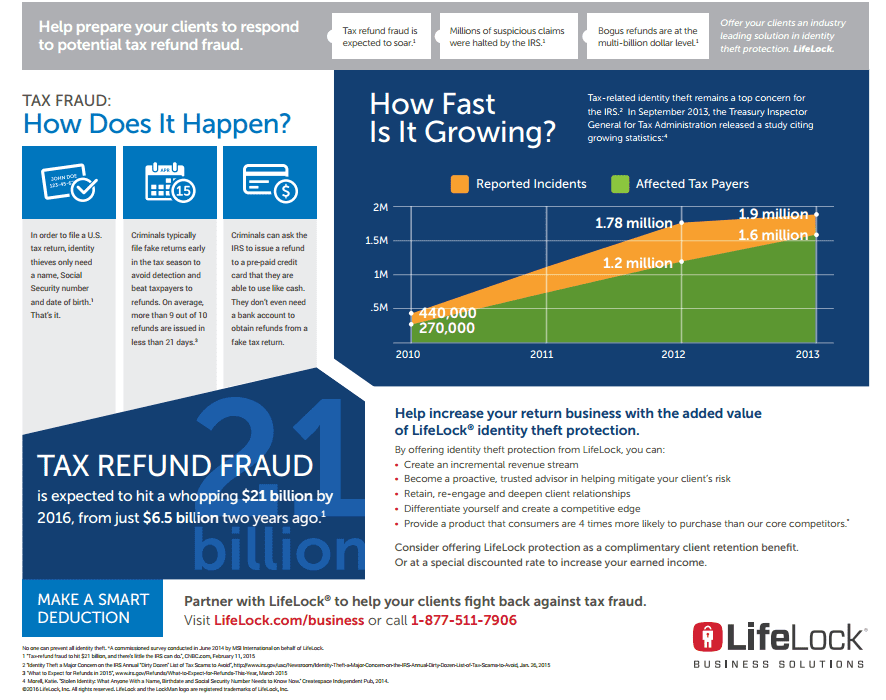

Topping the list of the IRS’s “dirty dozen” tax scams once again is tax-related identity theft. Tax related identity theft is when a criminal uses your stolen social security number to file a tax return claiming a fraudulent refund. The criminals who carry out this IRS scam usually file very early in the season, beating the taxpayer to their refund. Criminals also request the refund in the form of a prepaid debit card so that you can not trace the stolen refund to a bank account. Usually, victims will not even know that a fake return has been filed until they try to submit their legitimate taxes and the IRS tells them that a return has already been processed. To fight back against IRS scams such as this one, avoid giving your social security number or taxpayer ID unless it is truly necessary; just because somebody asks you for it does not mean you have to give it to them. Never give out personal information to anybody who calls you. Unless you are the one to initiate contact, you have no way of knowing if you are speaking with a legitimate IRS agent. If you are worried about becoming a victim of tax related identity theft, check out the IRS’s information on Identity Theft Victim Assistance.

Next on the list of IRS scams are those that take place over the phone. During these scams, criminals call people out of the blue and impersonate IRS representatives. The callers often aggressively threaten victims and demand payment for fictitious fines or penalties. In many cases, the criminals will even spoof the call so that IRS shows up on your caller ID. The reason these IRS scams work is because everybody is just a little bit afraid of the IRS based on their reputation. Scammers try to use fear to their advantage and threaten things like arrest, deportation, license revocation, or legal reprimands. Usually, phone scammers prey on the elderly, recent immigrants, and those who learned English as a second language. Sometimes, these IRS scams go as far as to have a criminal partner call immediately after the first scammer has called and claim to be from the DMV or police station, making the threats made by the previous caller seem much more real.

So, with so many ways that criminals can hide themselves or impersonate others, how can you be sure that you are dealing with a scammer or not? There are 5 things the IRS will NOT do, that scammers often do. Here are the 5 ways to quickly spot a phone scam:

- The IRS won’t call you without written correspondence first.

- The IRS won’t demand payment without letting question or appeal the amount that you owe.

- Scammers often insist that you pay with a prepaid debits card so that you can not charge it back to your account. The IRS will never require you to use a specific form of payment.

- The IRS won’t ask for credit cared or debit card numbers over the phone.

- The IRS won’t threaten to have you arrested for non-payment.

Other IRS scams that made the dirty dozen include phishing schemes. Phishing usually involves fake emails or websites that are used to try and steal personal information from potential victims. Scammers set up fake websites that look like legitimate IRS webpages, or they send emails to potential victims that indicate that there are fines or penalties due, or personal information that needs updating. The website address linked within the email will appear to be to the government site, but when you click the link it will take you to the fake page. Once you enter any personal or payment information on this page, the scammer s capture it. Scammers will then either use this information themselves, or sell it to criminals who will commit identity theft.

How can you know if an email or web link from the IRS is legitimate? It is quite simple, really, unless you email the IRS first and they are responding, they will not initiate contact with you via email. IRS scams usually involve text messages, social media, or emails, but the IRS will almost always reach out to you with a written letter if they are trying to contact you. To keep your personal information safe, remember to always use a firewall on your home and business networks, and keep your usernames and passwords unique for each website or email platform. Maintain an up to date anti-malware software to protect you from phishing, and utilize encryption any time you can when sending personal data. Lastly, check your credit report annually to keep an eye out for fraud, and remember to look for “https” before the web address of a link to ensure that the website is secure.

About The Author: Andrea Eldridge is CEO and co-founder of Nerds On Call, a computer repair company that specializes in on-site and online service for homes and businesses. Andrea is the writer of a weekly column, Nerd Chick Adventures in The Record Searchlight. She prepares TV segments for and appears regularly on CBS, CW and FOX on shows such as Good Day Sacramento, More Good Day Portland, and CBS 13 News, offering viewers technology and lifestyle tips. See Andrea in action at callnerds.com/andrea/.