The FTC estimates that as many as 9 million Americans have their identities stolen each year. According to data compiled by Zone Alarm, maker of antivirus and firewall software, identity theft results in an average cost to victim of $4,841 and takes, on average, 33 hours to resolve. With more and more of our personal information available online, it’s imperative that you take steps to protect yourself online.

our nerds can help you prevent your identity from being stolen!

Buyer beware. For as little as $30 in web hosting fees, criminals can set up fake online shop fronts to lure consumers into submitting their personal information and credit account numbers. Be wary of online retailers that you’ve never heard of, particularly if they’re offering a popular item at a lower-than-expected price.

If you can’t resist the deal, contact your credit card company to inquire if they offer one-time-use card numbers that you can use for vendors you don’t trust, or consider using a Visa or Mastercard gift card to protect your permanent account number. Never supply unnecessary personal information like your social security number, driver’s license number, or date of birth when completing an online retail transaction.

Pump up your password. I know, I know, I’m a broken record with this one. But if you’re one of the millions of Americans using the most popular passwords, such as “password,” “trustno1,” “abc123,” “monkey” or “letmein” (for the top 25 worst passwords, check out the list at SplashData, you’re putting yourself at risk. Morgan Slain, CEO of SplashData (a provider of password management applications) explains, “Hackers can easily break into accounts just by repeatedly trying common passwords.” He recommends using an online password management tool. I like Lastpass which can create and store unique, difficult to crack passwords for every site you visit online.

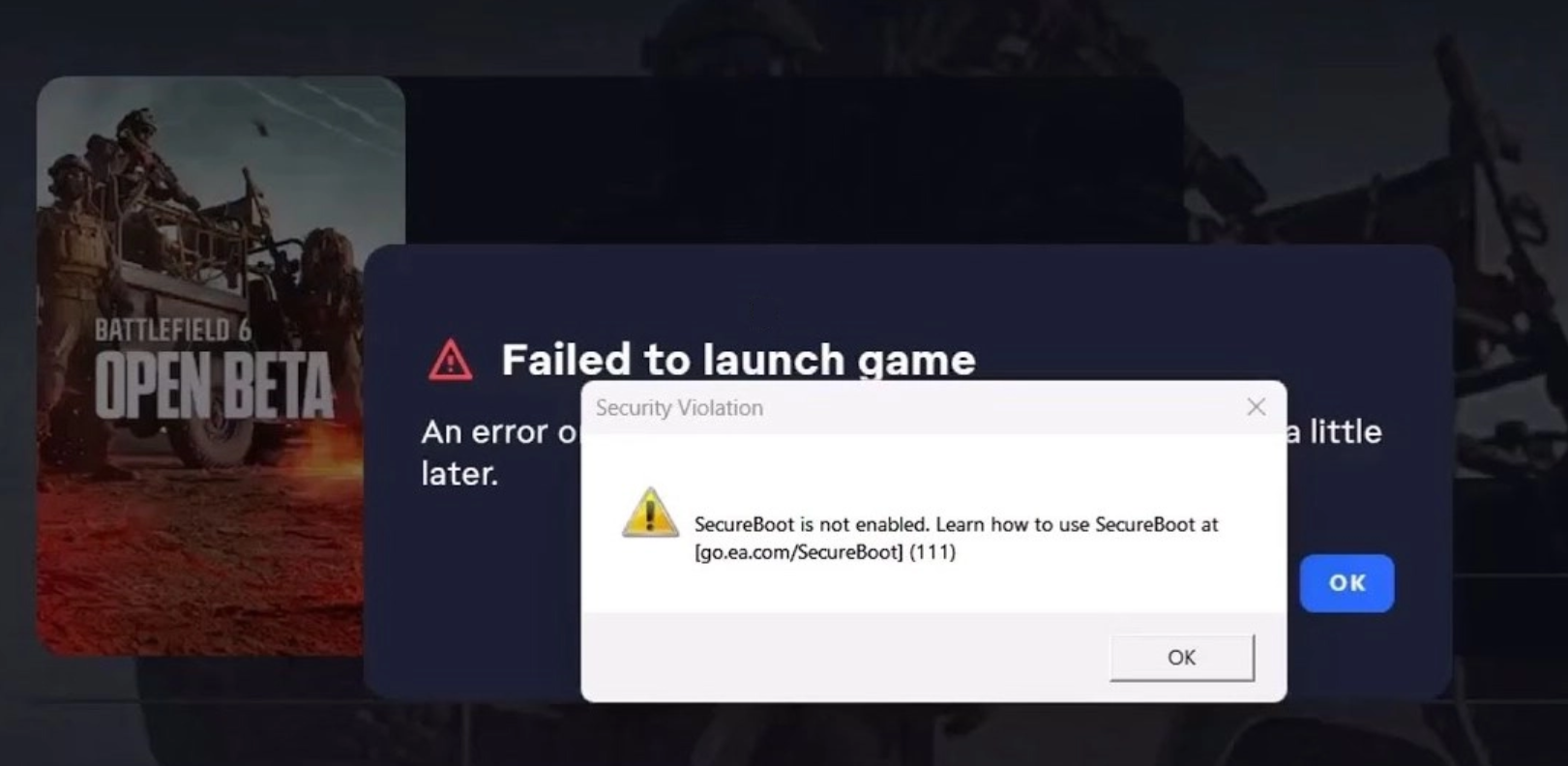

Secure your Smartphone. As more people acquire Smartphones, our personal information is going mobile. With instant access to email, social media accounts and often banking and credit account logins, Smartphones are an identity thief’s goldmine. Make sure that you password-protect the home screen to make it a little harder for a would-be criminal to access your data.

Consider storing account numbers and personal data that you regularly access (like bank account and passport numbers or alarm codes) in a cloud-based data vault program like that offered by Personal (free for iPhone and Android). Accessing the vault is password protected so it’s more secure than using notes, emails or texts stored on your phone.

Take notice of data breach notifications. With all the credit card offers, balance transfer promotions and junk mail sent by the average financial institution, it’s easy to tune out a form notification that your account data may have been compromised, but it’s important to take note. According to the “2013 Identity Fraud Report” compiled by Javelin Strategy & Research, almost 1 out of every 4 consumers that received a data breach notice letter became a victim of identity fraud. Of particular concern: “consumers who had their Social Security number compromised in a data breach were five times more likely to be a fraud victim than an average consumer.”

Take action. While the majority of identity theft activities are identified by third parties (55% vs. 45% discovered by consumers), it’s important to be proactive in your monitoring of account activity. The sooner you discover the fraud and take steps to close accounts and notify the appropriate parties, the less you stand to lose.

About The Author: Andrea Eldridge is CEO and co-founder of Nerds On Call, a computer repair company that specializes in on-site and online service for homes and businesses. Andrea is the writer of a weekly column, Nerd Chick Adventures in The Record Searchlight. She prepares TV segments for and appears regularly on CBS, CW and FOX on shows such as Good Day Sacramento, More Good Day Portland, and CBS 13 News, offering viewers technology and lifestyle tips. See Andrea in action at callnerds.com/andrea/.